Benchmarking & Worldwide Trends in Sales of Dive Gear in The Scuba Diving Industry by Product Category & Region

Market Reports from Dive RETAILERS and Scuba Diving Equipment Brands, MANUFACTURERS, Distributors, Reps & Agents.

Recreational Scuba Diving, Tech Diving, Freediving & Snorkeling Gear. Wholesale & Retail Sales.

This 2024 dive industry market report is part of a series of eight scuba diving industry market reports from the annual State of The Dive Industry survey.

Considering the extraordinary amount of time this scuba market study requires (by us and by dive industry professionals answering the survey), we have opted to conduct this study once every 2 years instead of annually. Subscribe to be kept in the loop.

This post is part of our Dive Industry Compass series by the Business of Diving Institute and Darcy Kieran, author of:

Contents on This Page

In early 2024, the Business of Diving Institute conducted the second annual State Of The Industry (SOTI) survey of the dive industry in collaboration with InDEPTH Magazine. We looked at 2023 results for dive certifications, scuba diving equipment sales, and dive travel compared to the prior year. We also surveyed expectations and forecasts for 2024.

We extend a special thank you to all those of you who participated in this effort to help the dive industry with more readily available market data.

Find a complete list of 8 market reports from the State of The Dive Industry 2023 study here. Subscribe to stay in the know.

You may consult the number of respondents per business category and geographical region here.

Trends in Sales of Dive Equipment by Product Type & Region

In this dive industry market report below, we look at sales of diving equipment by category and by region as reported by wholesalers and retailers.

Categories of gear include snorkeling, freediving, scuba diving, tech diving, surface-supplied air, swimming, surf boards, paddleboards & apparel.

Within scuba diving equipment, we look at dive computers, BCDs & regulators, rebreathers, wetsuits and other exposure suits, fins, masks & snorkels, and accessories.

- First, we will summarize 2023 results & 2024 forecasts from dive gear wholesalers, including scuba diving brands, manufacturers, distributors, sales reps, and agents.

- Then, we will look at dive gear sales results for 2023 and forecasts for 2024 by dive retailers.

In both cases, we segment the dive industry market reports by category of product and by region.

As reference points, we also include 2022 results and 2023 forecasts from last year’s SOTI market study of the dive industry.

1) Trends Reported by DIVE GEAR MANUFACTURERS

To simplify the text, in this market study, “manufacturers” include all wholesaler-related reports from brands, manufacturers, distributors, reps & agents.

Sales Revenues of Dive Gear Manufacturers

The participating dive gear manufacturers reported the following about their 2023 revenues over 2022:

- 7% reported a substantial decrease (-15% & less)

- 22% reported a decrease (between -5% and -15%)

- 36% reported flat revenues (+/- 5%)

- 21% reported an increase (between +5% and +15%)

- 14% reported a substantial increase (+15% & more)

Scuba diving equipment manufacturers have the following expectations for revenues in 2024:

- 7% are forecasting a decrease (between -5% and -15%)

- 49% expect flat revenues (+/- 5%)

- 44% are forecasting an increase (between +5% and +15%)

Profitability of Scuba Diving Equipment Manufacturers

The participating dive gear manufacturers reported the following about their 2023 profitability over 2022:

- 21% reported a decrease (between -5% and -15%)

- 51% had flat profits (+/- 5%)

- 15% reported an increase (between +5% and +15%)

- 13% reported a substantial increase (+15% & more)

Scuba diving equipment manufacturers have the following expectations for profits in 2024:

- 21% are forecasting a decrease (between -5% and -15%)

- 57% expect flat revenues (+/- 5%)

- 22% are forecasting an increase (between +5% and +15%)

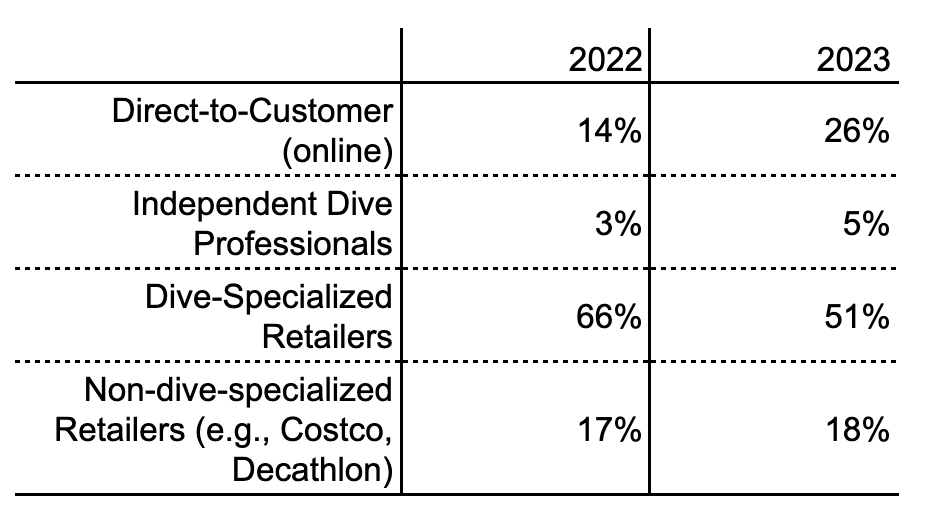

Dive Gear Manufacturers Sales Channels

With the significant reduction in the number of dive shops, especially during the COVID-19 pandemic, it is not surprising to see dive gear manufacturers pushing for online sales direct to customers.

The percentage of sales done by scuba diving equipment manufacturers through the traditional dive shop has shrunk by 20% while their direct-to-customer sales have almost doubled.

We have to be careful when using these numbers to evaluate the size of the market because revenues from direct-to-consumer are done at retail prices while sales to dive-specialized shops are done at wholesale. Furthermore, we evaluate that about half the sales in the “dive-specialized retailers” category are done to traditional brick-and-mortar local dive shops and the other half to non-traditional specialized retailers. We will seek to further clarify this in the 2025 State of the Dive Industry survey.

1.1) Dive Gear Manufacturers – Sales By PRODUCT CATEGORY

Trends in Units Sold by Product Category as Reported & Forecasted by Diving Equipment Manufacturers

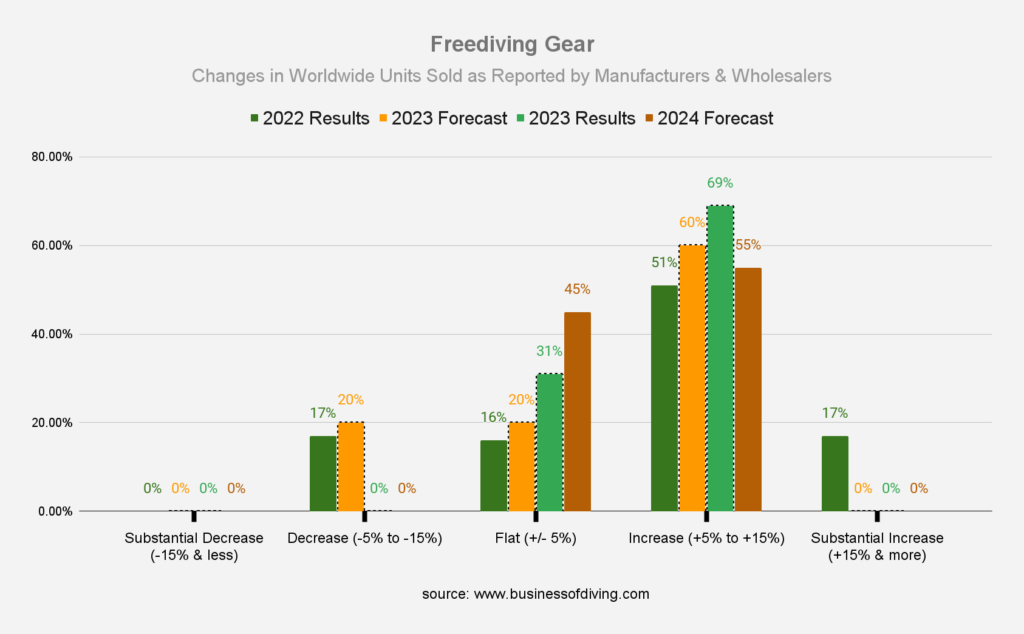

Rebreathers and freediving equipment were the only two categories of gear for which the 2023 results were higher than initial expectations.

Freediving continues to do very well – much better than scuba diving. In freediving, 69% of manufacturers reported growth, and none reported a decrease in sales over 2022.

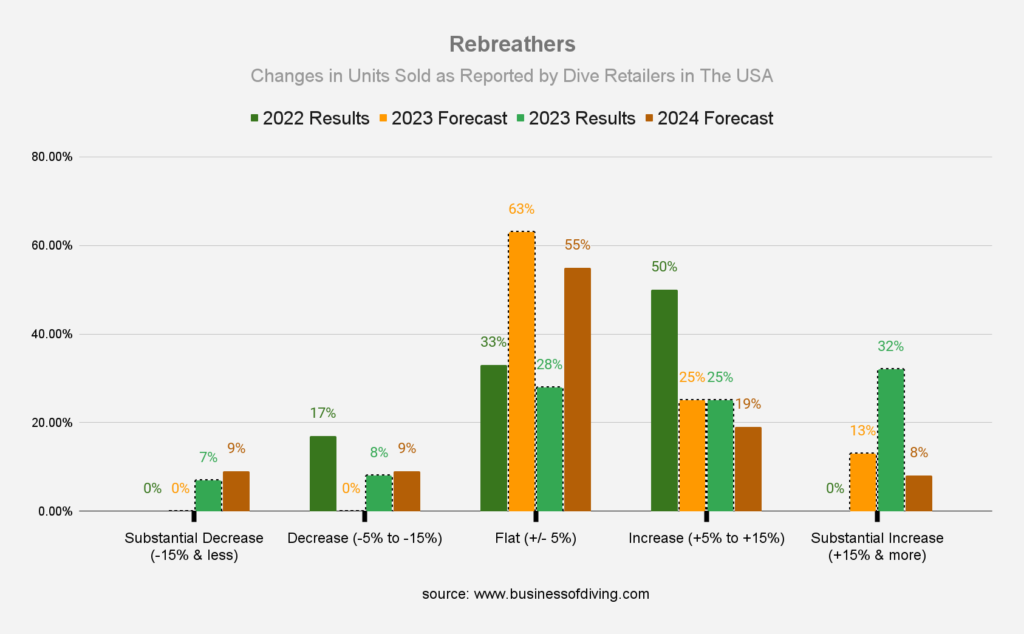

In rebreathers, 72% of manufacturers reported an increase in units sold, but 28% reported a decrease.

Scuba diving (overall) was the category of products with the highest percentage of manufacturers (31%) reporting a decrease in units sold, while 30% reported an increase.

Scuba Diving Gear Sub-Categories

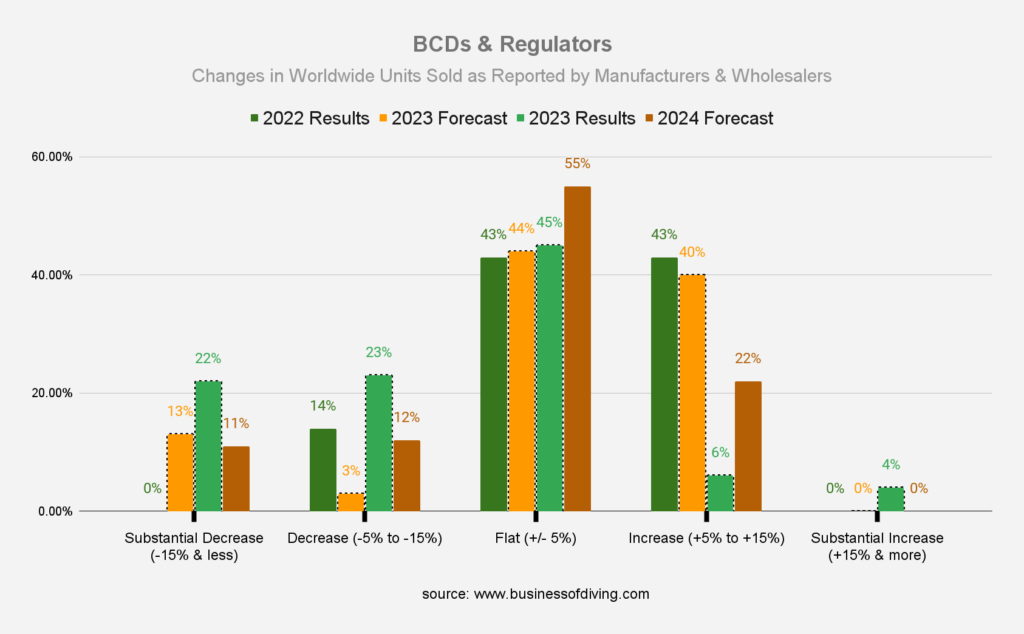

Within the scuba diving equipment market, the worst performing sub-category in 2023 was ‘BCDs and regulators’, with 45% of dive gear manufacturers reporting a decrease in sales and only 10% reported an increase.

Dive gear that tends to be purchased by casual divers did much better: dive computers, exposure suits, and accessories were the 3 best-performing sub-categories of products within the scuba diving equipment market.

This is not a surprise. When we look at the participation rate (for which we are preparing a 2024 update – subscribe to stay in the know), we see a sharper decline among core divers than among casual divers. And core divers are the ones buying hard goods like BCDs and regulators.

The percentages in the graphs below indicate how many survey respondents reported or forecasted a decrease, flat, or increase in units sold.

Green columns represent actual results (2022 & 2023), while orange-brown represents the forecasts (2023 & 2024). Both columns for 2023 are wrapped by a black dotted line to make it easier to compare the 2023 forecast to the actual 2023 results.

Sub-categories of Products Within Scuba Diving:

Later on, below, we will look at the same categories of scuba diving equipment, but this time, as reported by dive shop retailers.

For now, let’s have a look at sales results and forecasts from scuba diving gear manufacturers, brands, wholesalers, and agents per geographic region.

1.2) Dive Gear Manufacturers – Sales By REGION

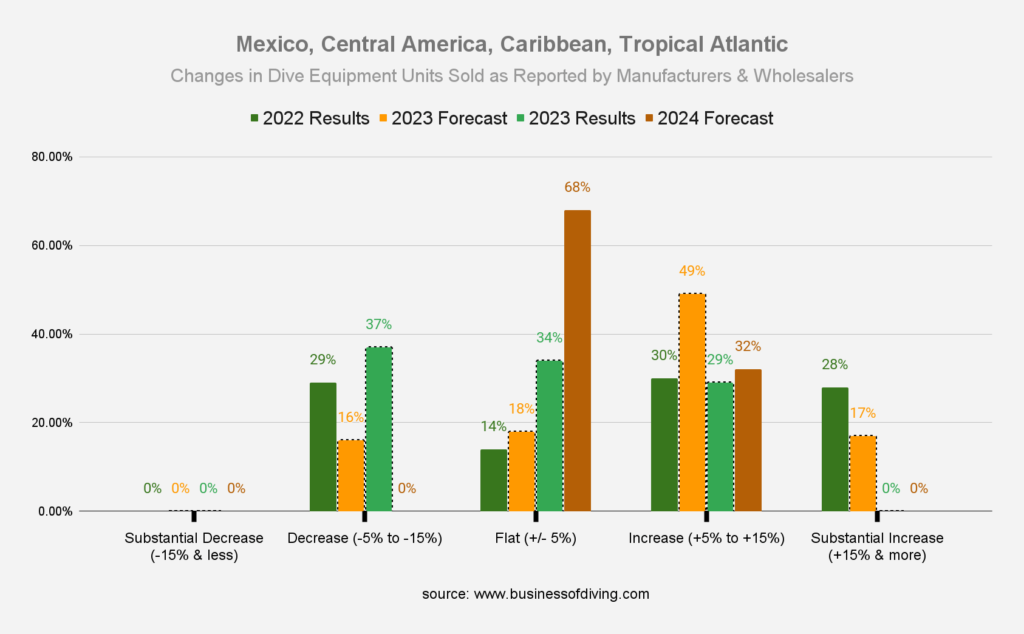

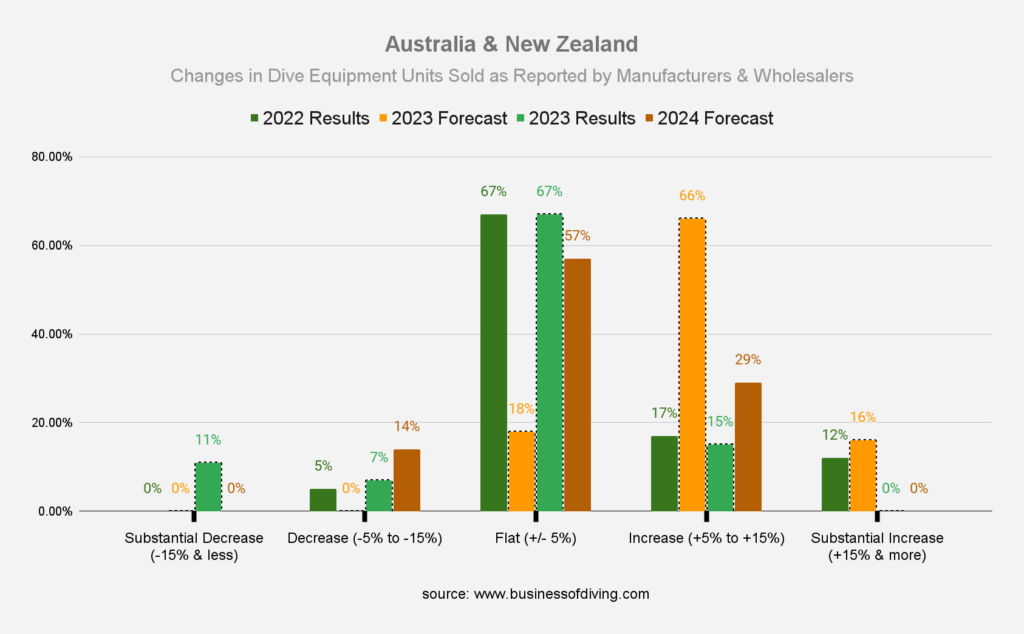

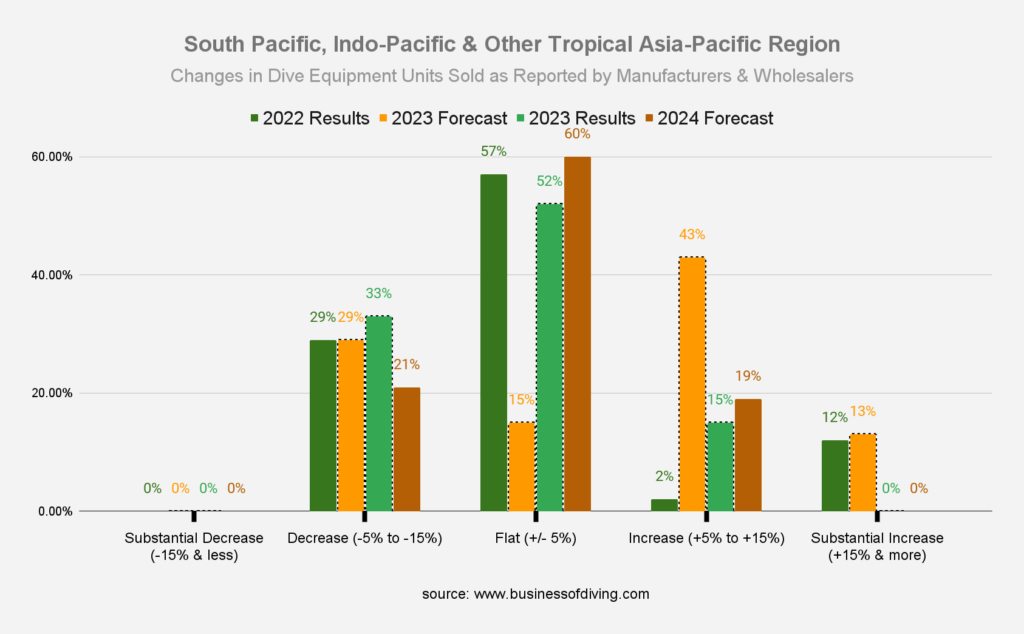

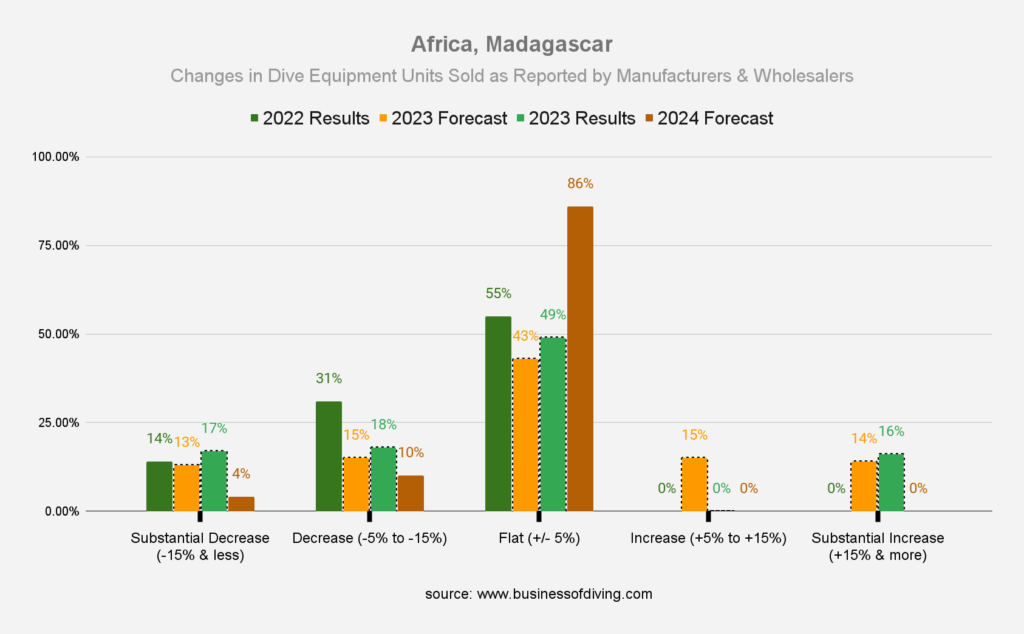

Trends in Units Sold by Geographic Region as Reported & Forecasted by Dive Equipment Manufacturers

Just as we saw with scuba diving certifications reported by dive training agencies, the USA did much better in gear sales in 2023 than its neighbors, Canada & Mexico.

Western Europe also did relatively well in 2023, while Eastern Europe had a much harder time.

The recovery in the Asia-Pacific region fell short of expectations in 2023. Only 15% of dive manufacturers reported an increase in the number of units sold in the South Pacific & Indo-Pacific region, while 56% had forecasted growth at the beginning of the year.

Overall, dive equipment manufacturers are pretty optimistic about 2024, except for Eastern Europe.

The percentages in the graphs below indicate how many survey respondents reported or forecasted a decrease, flat, or increase in units sold.

Green columns represent actual results (2022 & 2023), while orange-brown represents the forecasts (2023 & 2024). Both columns for 2023 are wrapped in a black dotted line to make it easier to compare the 2023 forecast to the 2023 results.

2) Changes in Dive Equipment Units Sold by Category as Reported by Scuba Diving Industry RETAILERS

On top of surveying dive gear manufacturers, brands, wholesalers, and agents on their 2023 results and 2024 forecasts, we also surveyed dive centers.

Unfortunately, we can only report dive gear sales trends at the retail level for the USA and Western Europe because the sample size was too small in other regions. We are working on fixing this issue for the 2025 survey – with your help!

You can help us provide you with better FREE dive industry market reports by participating in our surveys and inviting your colleagues to do so.

Please subscribe and invite your colleagues to participate in our ongoing dive industry market surveys.

For now, if you want dive gear sales trends for other regions besides the USA and Western Europe, you have those reported by dive gear manufacturers (above).

2.1) Changes in Units Sold by Category of Dive Equipment as Reported & Forecasted by Dive Industry Retailers in The USA

In the USA, in 2023, scuba diving gear was the worst-performing category among those we are tracking. That being said, dive retailers didn’t all experience the same sales results:

- 40% of dive retailers in the USA reported a drop in sales of scuba diving equipment

- 21% had flat sales

- 39% of dive retailers in the USA reported growth

Categories that were positive for most scuba diving industry retailers in the USA in 2023 were:

- Freediving gear

- Tech Diving Equipment

- Surface-supplier Air Diving Equipment

- Swim Equipment & Accessories

Sub-categories of Products Within Scuba Diving:

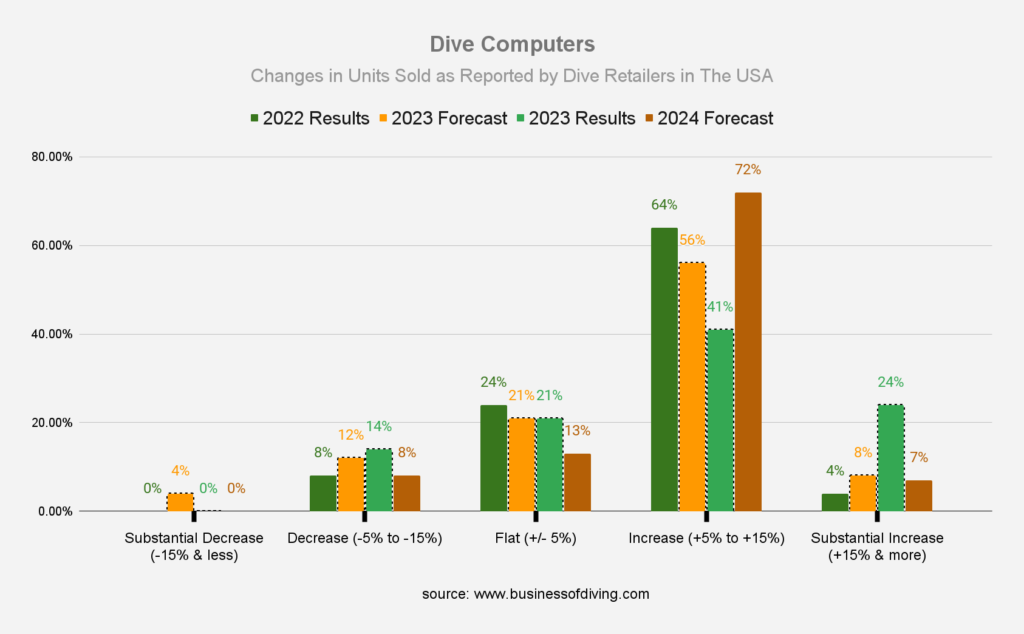

Within scuba diving, the best-performing category of products was scuba diving computers with 65% of dive retailers reporting an increase in the number of units sold in 2023.

As we saw in the dive industry market trends reported by scuba diving gear manufacturers (above), ‘BCDs and regulators’ was the worst-performing category of dive equipment. As mentioned earlier, this is consistent with a significant drop in core divers, who are the ones most likely to buy a complete set of scuba diving gear.

These results make it weird that 84% of dive industry retailers in the USA are forecasting growth in the scuba diving equipment category in 2024. I hope they are right, but considering historical trends in scuba participation and casual divers, it looks a bit like wishful thinking.

The percentages in the graphs below indicate how many survey respondents reported or forecasted a decrease, flat, or increase in units sold.

Green columns represent actual results (2022 & 2023), while orange-brown represents the forecasts (2023 & 2024). Both columns for 2023 are wrapped in a black dotted line to make it easier to compare the 2023 forecast with the actual 2023 results.

Sub-categories of Products Within Scuba Diving:

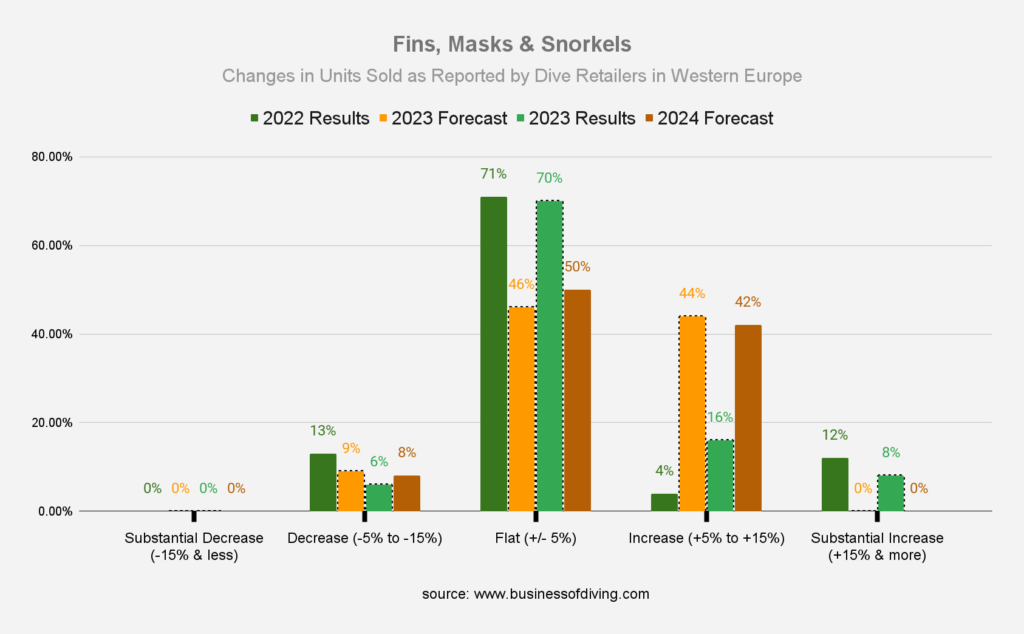

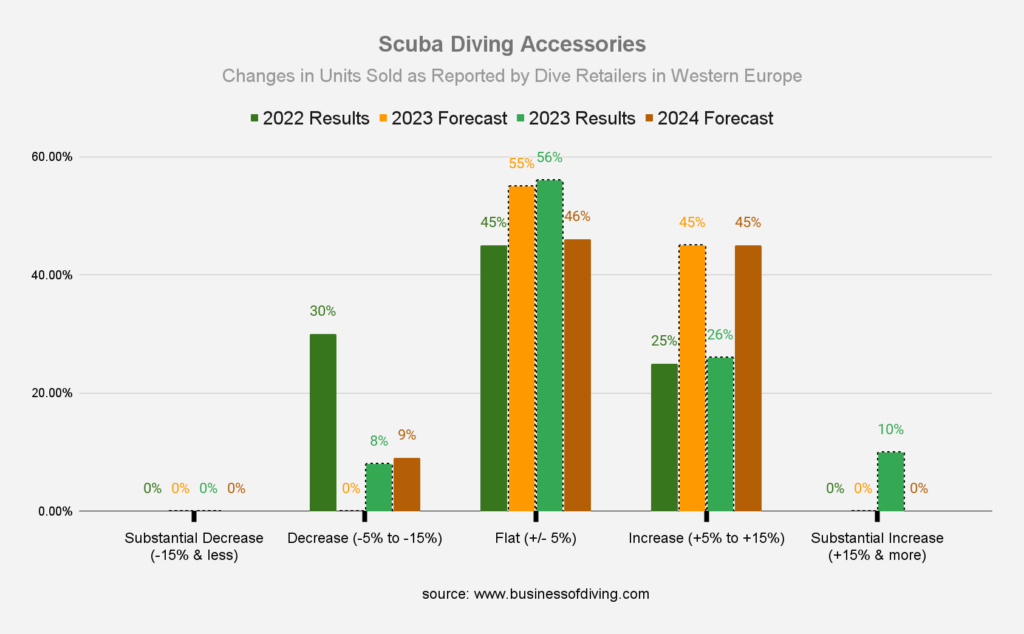

2.2) Changes in Units Sold by Category of Dive Equipment as Reported & Forecasted by Dive Industry Retailers in WESTERN EUROPE

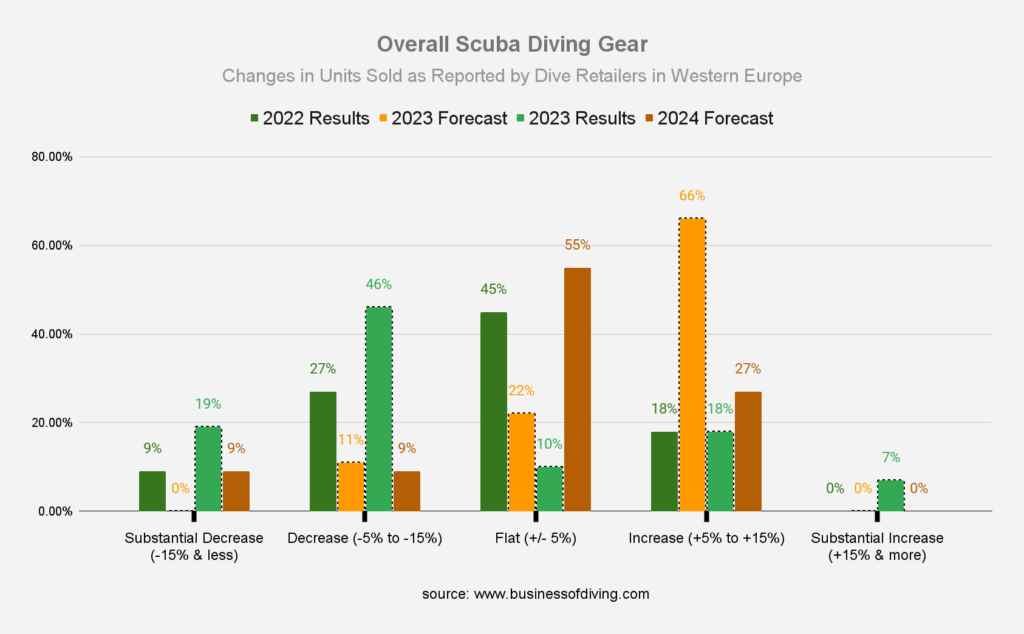

In Western Europe, in 2023, scuba diving gear was the worst-performing category among those we are tracking – just like it was in the USA. However, more dive retailers in Western Europe reported a decline.

- 65% of dive retailers in Western Europe reported a drop in sales of scuba diving equipment (40% in the USA)

- 10% had flat sales in Western Europe (21% in the USA)

- 25% of dive retailers in Western Europe reported growth (39% in the USA)

Categories that were positive for a majority of scuba diving industry retailers in Western Europe in 2023 were:

- Rebreathers

- Tech Diving Equipment

Sub-categories of Products Within Scuba Diving:

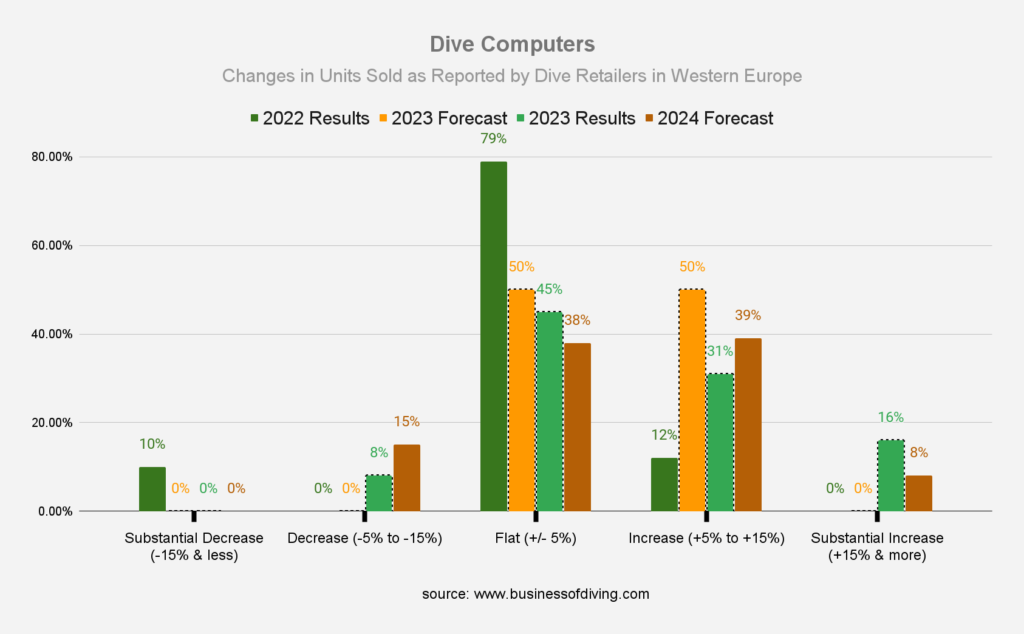

Within scuba diving, the best-performing category of products was scuba diving computers, with 47% of dive retailers in Western Europe reporting an increase in the number of units sold in 2023.

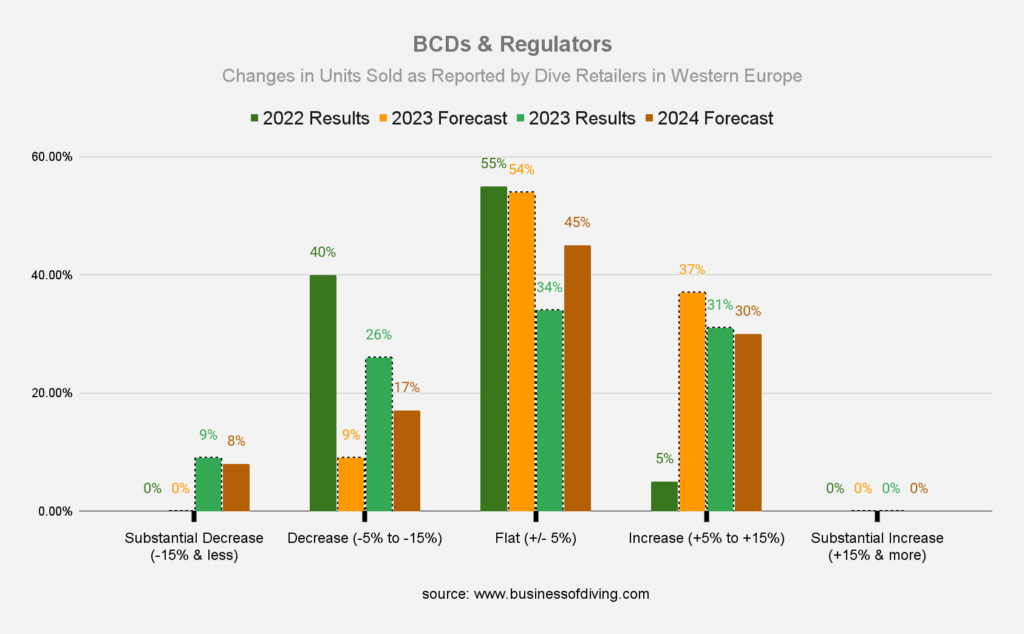

As we saw in the dive industry market trends reported by scuba diving gear manufacturers (above), ‘BCDs and regulators’ was the worst-performing category of dive equipment in Western Europe. As mentioned earlier, this is consistent with a significant drop in core divers, who are the ones most likely to buy a complete set of scuba diving gear.

The only two categories of scuba diving equipment for which a majority of dive retailers are forecasting growth in Western Europe in 2024 are:

- Rebreathers (75%)

- Tech Diving Equipment (73%)

Scuba diving computers are next at 47%.

The percentages in the graphs below indicate how many survey respondents reported or forecasted a decrease, flat, or increase in units sold.

Green columns represent actual results (2022 & 2023), while orange-brown represents the forecasts (2023 & 2024). Both columns for 2023 are wrapped in a black dotted line to make it easier to compare the 2023 forecast to the 2023 results.

Sub-categories of Products Within Scuba Diving:

There are eight scuba diving industry market reports prepared from the results of the State Of The Industry (SOTI) survey of the dive industry.

The State of The Dive Industry annual market study is part of a series of scuba diving industry surveys by the Business of Diving Institute in collaboration with InDEPTH Magazine with support from DAN Europe, Shearwater, GUE, and most importantly, YOU!

Besides participating in the surveys, please let us know if you would like to add your name to the official list of “supporters who are supporting the industry!”

Have a look at more scuba diving market research, surveys, reports & statistics in Your Dive Industry Compass.

If the information in this post was valuable to you, would you consider buying me a coffee?

Either way, please help the dive industry by taking part in ongoing surveys. Results from our past scuba diving market studies are also available here.

Your Dive Industry Compass

Scuba Diving Market Research, Surveys, Reports & Statistics

Business of Diving Blueprints 4.0

Scuba Diving Industry Structure, Competitive Analysis, Business Models & Strategies for Growth With The New Scuba Diver

Living The Scuba Dream

Plan Your Scuba Instructor Career & Deep Dive the Plan

You may also be interested in The Immersion Zone (our podcast), Scubanomics (our newsletter for dive professionals), and our published books & reference guides.